Despite significant performance upgrades in frequency and geometry performance/clock cycle, analysts don’t expect the competitive landscape to change.

Analysts may be impressed with Vega, Advanced Micro Devices’ next-generation graphics processor, but they don’t expect that it

will alter the neck-and-neck performance race it is running with its archrival, Nvidia.

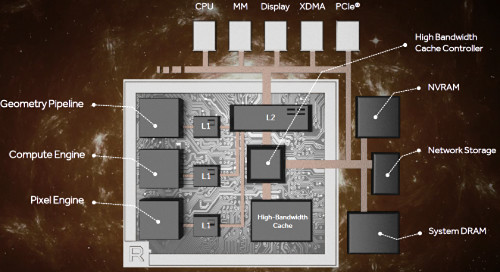

AMD disclosed the architecture of the new GPU but not details of its specifications or performance. Vega sports advances across its memory and logic subsystems.

In memory, the chip will ride a silicon substrate with up to two stacks of version 2 of high-bandwidth memory (HBM2) and sport an improved L2 cache and cache controller. In logic, it includes a new programmable geometry pipeline, compute unit, and pixel engine.

The chip will sport significantly higher frequencies than AMD’s current gigahertz GPUs, the company said. In addition, it should deliver twice the instructions and double the geometry performance per clock cycle, according to Raja Koduri, chief architect of AMD’s graphics division.

Vega could deliver an average 50% boost on Viewperf performance and 20% on application benchmarks compared to its current Polaris chip, said Alex Herrera, a senior analyst at Jon Peddie Research. He called it a “push beyond what we’d call minor incremental improvements from the Graphics Core Next (GCN)” of 2011, but “not a from-scratch design, still fundamentally carrying on the original GCN approach and architecture.”

The chip should ship by June, beating by several months Nvidia’s next-generation GPU, Volta, also expected to use HBM2 memory. “While Vega looks to be a win for AMD, it’s not likely to be a major game-changer, unless Nvidia were to stumble down the homestretch bringing Volta to market,” he said.

Nvidia is expected to refresh its current Pascal GPU with higher clock speeds and GDDR5 memory this year, but save Volta and HBM2 until early 2018, said Kevin Krewell, senior analyst with Tirias Research.

Analysts expect that Vega and Nvidia’s 2017 Pascal refresh will both be made in 14nm process technology. “I don’t expect Nvidia to move to 10 nm or 7 nm until Volta,” said Krewell.

Pioneering high volume 2.5-D chip stacks

AMD’s decision to support packed 8- and 16-bit math on Vega will boost its performance in machine earning jobs, Krewell noted. For both companies, HBM2 will boost performance but at a significant cost increase over chips using traditional GDDR4/5 memory, he added.

Indeed, the two graphics giants find themselves unwitting pioneers of 2.5-D packages that pair their GPUs with memory stacks over fast interconnects. To date, FPGAs and networking chips have used the technology in low volumes in products that tolerate the high prices of the still-emerging packaging technology.

“I can’t price these things like I want to … I can’t just wrap dollar bills around them,” said AMD’s Koduri.

AMD was first to 2.5-D stacks for high-volume consumer graphics with its Fiji product last year, assembled by ASE Group with substrates from UMC. The company wants more suppliers and better yields, said Koduri.

“With the volumes we need, we want the entire supply pipeline enabled [for 2.5-D packaging] … In the end, all the difficulties translate to more cost,” he said.

Koduri was sceptical that a group of at least three start-ups focused on machine learning (Cornami, Graphcore, and Wave Computing) or Intel’s new Nervana chip will leapfrog AMD and Nvidia with new architectures. “Their fundamental road block is they don’t have the compilers,” he said, noting that it can take three years to produce mature, optimised software.

“We are moving on an annual refresh cycle driven by the game market and that’s great for” still-evolving machine learning applications, Koduri said. When the algorithms settle down, “someone, someday, will find a smarter way to solve the problem … I’m still astounded how brute force it is,” he said.