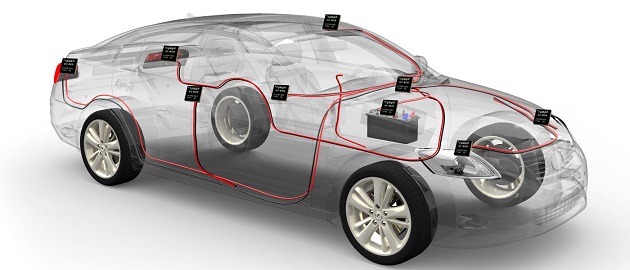

Power electronics are incorporated in Automotive for numerous applications including energy transformation, motion control, and switching power supplies. They are used for controlling automotive electronics such as seat controls, advanced driver assistance systems (ADAS), electric power steering, braking system, infotainment, safety systems, and telematics.

Global automotive power electronics industry is classified into power discrete, power ICs, and power module. Various application areas include powertrain, safety & security electronics, and body electronics. Based on drive type, the industry is divided into pure electric vehicle, hybrid vehicle, and IC engine vehicle. Whereas, different vehicles considered are commercial vehicles, and passenger cars.

As per seasoned analysts, Asia Pacific contributed substantially towards worldwide automotive power electronics market remuneration in the past years and is reckoned to showcase similar trends in the ensuing years. Soaring production of luxury passenger cars, automaker focus on reducing vehicle weight, and presence major vendors in the region are positively swaying the business dynamics in APAC.

Expert claim the global automotive power electronics market amassed USD 3.6 billion in 2019 and is anticipated record a compound annual growth rate of 4.7% through 2027. Increasing adoption of hybrid and electronics vehicles in an effort towards reducing harmful emissions is boosting the demand for power electronics in order to enhance switching speed and avert power loss.

The overall market space is studied based on device terrain, application scope, drive type, and vehicle ambit. A thorough summary of regional markets and their contribution towards the total remuneration is also elucidated in the report. It also expounds on the competitive dashboard of the industry, while throwing light on the business profile, product portfolio, as well as expansion strategies of various contenders.

As per records, worldwide electric vehicle sales were recorded at 197,000 units in Q1 of 2017, which surged 58% to reach 312,000 units in Q1 of 2018. Likewise, report by Bloomberg New Energy Finance claimed that global electric vehicle sales are expected to cross 54 million by the year 2040.

Global Automotive Power Electronics Market by Device Ambit (Revenue, USD Billion, 2017-2027)

- Power Discrete

- Power ICs

- Power Module

Global Automotive Power Electronics Market by Vehicle Terrain (Revenue, USD Billion, 2017-2027)

- Commercial Vehicles

- Passenger Cars

Global Automotive Power Electronics Market by Drive Type (Revenue, USD Billion, 2017-2027)

- Pure Electric Vehicle

- Hybrid Vehicle

- IC Engine Vehicle

Global Automotive Power Electronics Market Application Scope (Revenue, USD Billion, 2017-2027)

- Powertrain

- Safety & Security Electronics

- Body Electronics

Global Automotive Power Electronics Market Regional Landscape (Revenue, USD Billion, 2017-2027)

Latin America

- Brazil

- Mexico

Asia Pacific

- South Korea

- India

- Australia

- China

- Japan

- Rest of APAC

North America

- United States

- Canada

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

RoW

Global Automotive Power Electronics Market Competitive Hierarchy (Revenue, USD Billion, 2017-2027)

- Valeo Group

- Toyota Industries Corp.

- Semiconductor Components Industries LLC

- STMicroelectronics N.V.

- Vishay Intertechnology Inc.

- Microsemi Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corp.

- Texas Instruments Incorporated

- Infineon Technologies AG