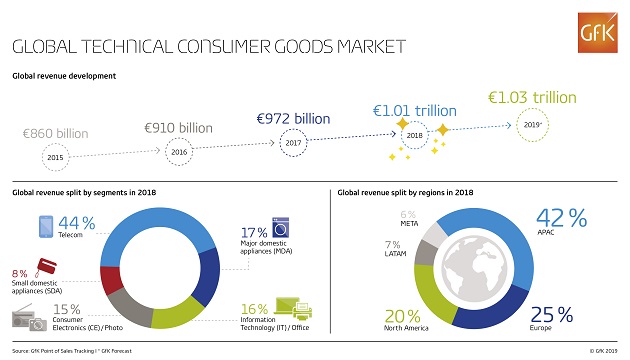

After a stable 2019, GfK experts expect for the global market for technical consumer goods a value growth of +2.5 percent in 2020. Consumers will spend an estimated €1.05 trillion globally. Telecoms (+3 percent), Small Domestic Appliances (+8 percent) and Major Domestic Appliances (+2 percent) will drive the growth. Sales of IT, Office Products and Consumer Electronics are forecasted to remain stable and almost unchanged from last year. These are GfK findings to coincide with CES 2020 in Las Vegas.

The positive growth of the tech and durable goods market in 2020 will happen across all regions, ranging from 2 to 3 percent in value. The regional mix remains almost unchanged from 2019 when the Asia-Pacific regions accounted for the majority of the sales turnover with 43 percent, while every fourth Euro was spent in Europe.

Pavlin Lazarov, GfK’s expert on technical consumer goods, explains: “We assume that with the expansion and spread of 5G, the telecom sector will return to growth after a turbulent 2019. The demand for smartphones in China and emerging Asia will be among the major drivers not only for the telecom sector but for the overall TCG market. Innovation, performance and premiumization will continue to be the key consumer trends boosting demand. With convenience, health and well-being winning consumer attention and spend, the strong demand for Small Domestic Appliances will continue, driven by both emerging and developed markets. At the same time, consumers are becoming increasingly digital and concerned about sustainability and how governments, manufacturers, retailers and consumers can be more environmentally friendly in the tech and durable space.”

The evolution of the consumer share of wallet

In 2020 GfK estimates that the telecom sector will account for more than 43 percent of total consumer spend of last year, generating €454 billion euro. The runner-up will be the Major Domestic Appliances sector with estimated sales of €187 billion euro. The IT and Office sectors are forecasted to attract over 15 percent of consumer spend globally, followed by Consumer Electronics. The latter will generate over €146 billion of sales, a 14 percent share. The rising star in the tech and durable goods market is the Small Domestic Appliances sector, which continues to attract more of the consumer budget. It is expected to grow its share in 2020 again, reaching over 9 percent of the consumer wallet with sales of €97 billion. The battle for consumer attention remains high on the agenda, and the question for 2020 will be to find the right approach that can help to win that battle.

Demand for rich experiences

Superb performance and innovation are the key ingredients that enhance the consumer experiences of technical products. These are often combined with a premium touch and elevated design. These trends are visible in the growing demand for OLED TV (+19 percent value growth), gaming notebooks (+15 percent value growth) and cordless hand stick vacuum cleaners (+23 percent value growth). Smartphones with screen sizes of at least 6” accounted for 73 percent of the generated sales in the first nine months of 2019 and rear cameras with more than 20MP captured 26 percent value share. This emphasizes the importance of features that deliver benefits, but also of the transformation of benefits into experiences such as messaging rich content, taking and sharing photos and videos, and watching videos.

Consumers are also willing to spend more on products that make their life easier, with 46 percent of the global respondents agreeing (GfK Consumer Life 2019). This is reflected in the robust growth of robot vacuum cleaner (+18 percent value growth) as a time and effort-saving solution, as well as wash-dryers (+29 percent in value terms), which combine the benefits of a washing machine and a tumble dryer in one. Smart watches are another example of a strongly growing category (+48 percent in value terms), which combines functionality and simplification to deliver better experiences.

The desire for rich experiences is set to continue with consumers being more informed, more digital and more concerned. At the same time, they feel empowered to decide for the most appealing products. Consumers are also ready to spend when they are convinced that products meet their needs, provide them with benefits, and ultimately deliver the experience they expected.

For more information, visit www.gfk.com