Century LED conducted a consumer survey across 4 cities (Delhi, Kolkata, Mumbai, and Bangalore) to understand the consumer behaviour and buying patterns of lights in the decorative space.

The objective of the survey was to understand the buying patterns of decorative lights and the consumer preference while buying lights. Century LED also wanted to understand the preference of the consumers in terms of -LED/CFL or incandescent and spends of the consumer.

A quantitative research was conducted by commissioning a questionnaire to an audience sample of 150+. The consumers were chosen randomly irrespective of sex, age, and socio-economic status.

This survey report covers a significant targeted range of public opinions on their awareness of LED lighting industry and its reach.

Key findings of the survey:

This section provides an overview and summary of key analytical points of the survey. The survey was attended by a large majority of youngsters within the age group of 25 years to 35 years. They accounted for 68.6% of total attendees. The next in line was the age groups of 36 years to 45 years and 46 years to 55 years, who accounted for 16% and 9.6% respectively. There were attendees of this survey beyond 55 years also, who formed a mere 5.8 % of the total sample size.

Among the total survey attendees, 46.2% were the homeowners. Among the rest, 14.7% were prospective homeowners, who were more likely to be the prospective decision makers in future. 32.7% of the total 157 persons were not homeowners so they had a more generalized approach towards the lighting industry. 6.4% of the total survey attendees were neither homeowners nor prospective owners; they were more likely to be the family members of the above-mentioned categories who could be the influencers in the light selection decision.

49.7% of the survey attendees used LED lights as a mode of lighting for their homes or offices. There were people who largely used CFL bulbs as their mode of lighting for their homes/offices and they accounted for 46.2% according to this survey. 5.1% and 1.9% of the total sample-size used Fluorescent bulbs and Incandescent bulbs respectively, which might be either for the low prices of the bulbs or for their unawareness. While embarking on this survey we came to know that 7.3% amongst the total attendees were unaware of the type of bulbs they used for their homes/offices. This shows the need for creating awareness about the lighting industry among these audiences.

35.7% of the total survey attendees bought lights themselves. Sometimes these light purchase decisions were taken by fathers, who form a 49.7% of the total attendees. Among the rest, according to 5.1%, decisions were taken by husbands. According to 7.6% and 1.9% of the total attendees, light purchase decisions were taken by wives and mothers respectively. 2.4% of the total sample size, depended on their kids or some other person in the family. For lighting up the offices’ Company influenced the decision of the buyers.

When asked about the energy efficiency of lights, around 82.2% of the total sample size mentioned LED bulbs. According to 15.3% and 2.5% people, CFLs, and Fluorescent bulbs were the most energy efficient respectively. Thus it was observed that these people efficiently knew that Incandescent bulbs were no way in the segment of energy efficiency.

According to this survey, around 40.7% of the total attendees purchased lights depending on its energy consumption. The other parameter considered was the longevity of a bulb. About 15.9% people bought checking a bulb’s longevity, 10.8% of the total sample size, purchased checking a bulb’s colour on their preference of warm light or cold light. Other two segments of people of the survey attendees, respectively 16% and 10.8% bought lights depending upon its brightness and price. Only 4.5% of the total findings prefer a specific brand’s tag on their chosen bulb. Other than these, 3% people combined the above-mentioned factors while choosing a bulb.

As a guideline for the brightness of a bulb, 53.5% of total 157 people relied on the wattage of a bulb while buying them. 23.6% of the total, checked with the bulb’s light output in Lumens. 16.6% did not use any guide for the brightness of a bulb and were influenced by the shop owner’s opinion and 6.4% tried to find any bulb that resembled their existing bulbs.

66.7% out of 157 people were familiar with the fact that LED bulbs use less electricity and act as an energy saver.12.8% people of the total attendees found LED Bulbs as a long-lasting lighting option, whereas 8.3% knew that it is a cost-effective option. 6.4% people knew that LED bulbs are eco-friendly and 4.5% were aware of its huge presence in the decorative lighting sector. Some people were well acknowledged with all of its qualities and 0.6% (though a very small segment) did not know about any of its qualities.

When asked about the brand preference of the samples, 61.1% people of them named Phillips LED and 29.3% named Syska LED for their homes and offices.1.9% people among the total chose Bajaj LED as an option to light up their Homes and Offices. Last but not the least, a segment of 7.6% chose Century LED.

48.4% of total people were ready to replace their old lighting systems with LED bulbs, whereas for 10.2% of the sample size, the kind of lights used did not matter. 41.4% people were the prospective segment to switch into the LED lighting solutions.

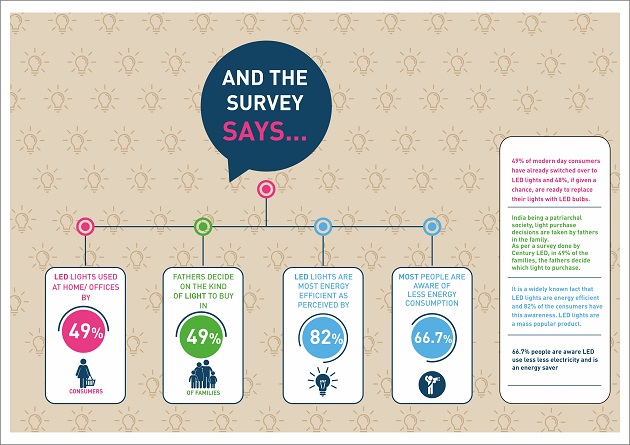

Overall, as per the survey, 49% consumers of 157 people use LED lights for their homes and offices. Also, fathers accounted for 49% in decision making while purchasing lights. LED lights were perceived as the most energy efficient solution in the lighting sector by 82% respondents.