Introduction

For the years to come, analysts expect significant growth in the global Automated Test Equipment (ATE) market, driven by the introduction of new technologies, highly integrated electronic components and by the greater complexity of new electronic devices. The reduced time-to-market, combined with the need to provide high quality standards for even the most advanced functionalities, are pushing manufacturers towards automatic test solutions, whose reliability and repeatability guarantees a significant reduction in time, maintenance and costs. ATEs help manufacturers to perform accurate tests and measurements, reducing the incidence of failures and errors, and providing test results much faster than with manual testing methodology. In view of growing competition and the consequent need to achieve economies of scale providing high quality products able to meet the growing consumer demand, manufacturers around the world are adopting automated testing techniques. The ATE solution in vertical sectors, such as semiconductor, consumer, automotive, industrial, aerospace and defense is set to grow the best in the coming years.

ATE classes

Automated Test Equipment (ATE) is a computer-controlled system that allows the automatic test of components, printed circuit boards, interconnections or entire electronic devices with minimal operator intervention. The advantages offered by an ATE include reduced test times, repeatability of the verification procedure and cost savings, especially in the case of high DUT (Device Under Test) volumes.

A first type of ATE deals with performing the test of semiconductors and integrated circuits. By applying a predetermined and programmable pattern of electrical signals to a semiconductor or an IC, the ATE measures the corresponding output signals and compares them with expected values or ranges. These systems can in turn be divided into logic testers, memory testers, and analog testers. Semiconductor testing, with DUTs ranging from common silicon-based components to complex integrated circuits and System-On-Chip (SoC), is normally divided into two levels. The first is the wafer test (also called die sort or probe test), whose task is to test the wafers. The second is the package test (also called final test), performed on the component after packaging. The wafer test uses a prober and a probe card, while the test package uses a handler and a test socket. The DUT is physically connected to the ATE through a device called handler, or prober, and through a customized Interface Test Adapter (ITA) that adapts the ATE resources to the DUT. This class of ATE includes logic test systems, designed to test microprocessors, FPGAs, ASICs and other logic devices, linear or mixed signal equipment (for testing ADCs, DACs, amplifiers, comparators and video devices), passives components ATEs (capacitor, resistor, inductor) and discrete ATEs (MOSFET, SCR, Zener, JFET, etc.).

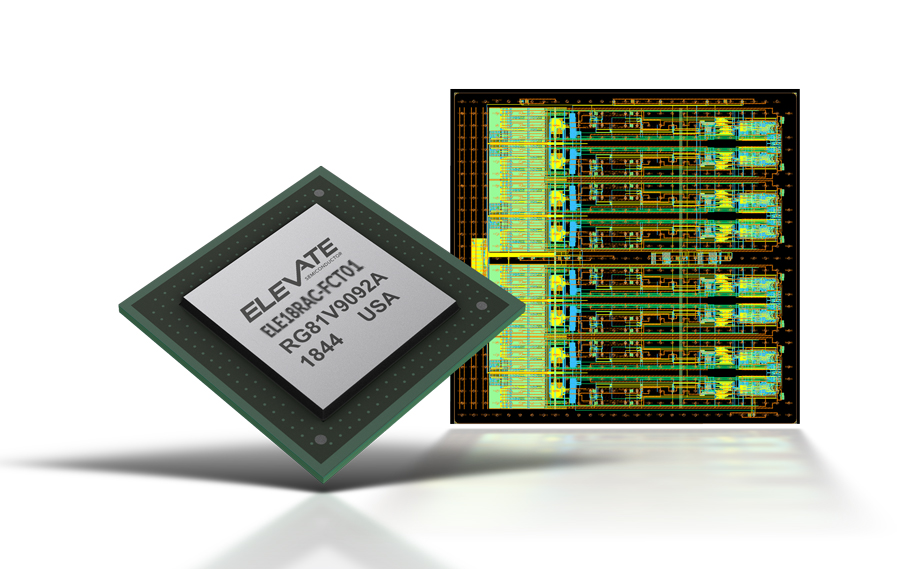

ElevATE Semiconductor, a leading supplier of innovative, low power, high density components for the design of next generation Automated Test Equipment (ATE), provides Mystery (visible in Figure 1), a 500 MHz SoC with eight independent pin channels for ATE equipment. Each channel is configured via a 50MHz SPI interface, and all real time data is programmed and read back through high speed FLEX I/O pins that can be configured to interface directly to other devices using multiple single-ended and differential logic families.

Figure 1: ElevATE Mystery SoC

New Rainier SOC 8 Channel / 1.6GHz

This new pin electronics SoC increases speed by 50%, reducing power by 67% and total size by 75%. A 50% speed increase allow to test even the most performant processor, SoC, FPGA, and memory technologies. A 67% power reduction allows to triple the number of pins or DUTs without increasing the power budget. A 75% size reduction allows to quadruple the number of pins under test without expanding the overall PCB size.

The second type of ATE deals with PCB testing (both before wave soldering and after assembly) in order to detect any manufacturing errors and ensuring that each product leaves the factory free from defects. Automated PCB testing includes optical inspection techniques, such as Automatic Optical Inspection (AOI) and Automatic X-Ray Inspection (AXI), flying probe test, and bed-of-nails in-circuit fixture test.

Finally, the interconnection testing verifies the status and quality of interconnections, cables and connectors. In particular, it is able to detect opens (missing connections), shorts (open connections) and miswires (wrong pins) on cable harnesses, distribution panels, flexible circuits, and membrane switch panels with commonly used connector configurations. Interconnection testing also includes resistance and hipot tests.

For Test During Burn-In (TDBI) applications and low-cost testers, ElevATE offers the Kilimanjaro SoC, shown in Figure 2. Fabricated in a wide voltage Bi-CMOS process, the Kilimanjaro incorporates two channels of programmable drivers and window comparators into a small 5mm x 5mm QFN package. Each channel has per pin driver levels, data, and high impedance control, along with per-pin high and low window comparator thresholds levels.

Figure 2: ElevATE Kilimanjaro SoC

ATE market segmentation

ATE market can be segmented based on the type of product, application or geographical area. Regarding the product, the market is divided into non-memory, memory, and discrete automated test equipment. Recent innovations in sectors such as IoT and automotive (including autonomous vehicles), together with the significant advances made by defense and aerospace sectors, are changing the dynamics of the market. The main objective of manufacturers is to improve customer satisfaction by providing superior quality and reducing both time-to-market and testing costs. Based on the application, main ATE market categories include automotive, consumer, aerospace and defense, telecommunications and medical. Geographically, the global ATE market is dominated by North America, whose market share is expected to grow further in the coming years, as well. The main drivers of growth are determined by the increasing application of ATEs in the aerospace and defence sectors. The global markets of Europe and Asia-Pacific are also expected to grow, with a CAGR between 3% and 4% through the 2020-2022 time horizon. In the same forecast period, the Asia-Pacific market is expected to become the largest regional segment, due to the significant presence of semiconductor industries.

Market future prospects

The global ATE market size, valued at over four U.S. billion dollars in 2019, is expected to witness important growth over the next few years. According to analysts, this growth will be driven by the increasingly widespread use of ATEs in the automotive and semiconductor industry, the adoption of 5G technology, and Artificial Intelligence/IoT markets growing rapidly. Other key factors are the significant increase in the number of connected devices and consumer electronics, with the need to provide high-quality products reducing the time to market. The growing adoption of highly integrated electronic components, such as System on Chip (SoC) and FPGAs, and the high demand for consumer electronics will be a driving force for the growth of the ATE market in the coming years. Moreover, the miniaturization and complexity of the latest generation electronic components will broaden the areas of application of ATEs.

The tremendous progress made in semiconductor manufacturing processes, coupled with the expansion of connected devices in developing countries and the spread of the IoT network, will be a driving force for the growth of the automated test equipment market in the coming years. Furthermore, the considerable technological advances associated with the complexity of the design and the need for effective test systems are factors that will favor the expansion of the ATE market. The latest electronic technologies have significantly reduced the costs and time required for manufacturing integrated circuits and semiconductors, increasing the profit margin reserved for companies. This represents an important opportunity for ATE manufacturing companies, whose priority is to constantly invest in research and development in order to improve their product portfolio by adapting to the latest trends in the electronics sector.