The global semiconductor manufacturing industry closed 2024 with strong fourth quarter results and solid year-on-year (YoY) growth across most of the key industry segments, SEMI announced today in its Q4 2024 publication of the Semiconductor Manufacturing Monitor (SMM) Report, prepared in partnership with TechInsights. The industry outlook is cautiously optimistic at the start of 2025 as seasonality and macroeconomic uncertainty may impede near-term growth despite momentum from strong investments related to AI applications.

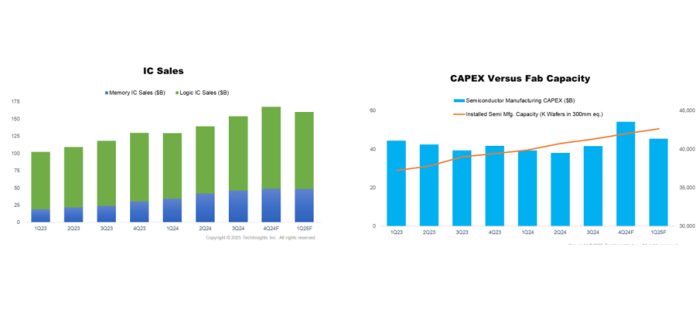

After declining in the first half of 2024, electronics sales bounced back later in the year resulting in a 2% annual increase. Electronics sales grew 4% YoY in Q4 2024 and are expected to see a 1% YoY increase in Q1 2025 impacted by seasonality. Integrated circuit (IC) sales rose by 29% YoY in Q4 2024 and continued growth is expected in Q1 2025 with a 23% increase YoY as AI-fueled demand continues boosting shipments of high-performance computing (HPC) and datacenter memory chips.

Similar to electronics sales, semiconductor capital expenditures (CapEx) decreased in the first half of 2024 but saw a strong rebound, particularly in the fourth quarter, resulting in 3% annual growth by the end of 2024. Memory-related CapEx continued to lead the growth surging 53% quarter-on-quarter (QoQ) and 56% YoY in Q4 2024. Non-memory CapEx also edged up in Q4 2024 showing 19% QoQ and 17% YoY improvement. Total CapEx is expected to remain strong in Q1 2025, growing 16% relative to the same period of the previous year on the strength of investments to support high bandwidth memory (HBM) capacity additions for AI deployment.

The semiconductor capital equipment segment remained resilient primarily due to increased investments into expanding leading-edge logic, advanced packaging and HBM capacity. Wafer fab equipment (WFE) spending increased 14% YoY and 8% QoQ in Q4 2024. Quarterly WFE billings are expected to be around $26 billion in Q1 2025. China’s investment continues to play a significant role in the WFE market but started to subside by end of the year. Additionally, back-end equipment showed strong increases in Q4 2024 with the Test segment logging 5% QoQ growth and an impressive 55% YoY increase for the quarter, while the Assembly and Packaging segment experienced a YoY increase of 15%. Both segments are expected to show similar QoQ growth between 6-8% in Q1 2025.

In Q4 2024, installed wafer fab capacity surpassed a record 42 million wafers per quarter worldwide (in 300mm wafer equivalent), and capacity is projected to reach nearly 42.7 million in Q1 2025. Foundry and Logic-related capacity continues to show stronger increases, growing 2.3% QoQ in Q4 2024, and the segment is projected to rise 2.1% in Q1 2025 driven by capacity expansion for advanced nodes. Memory capacity increased 1.1% in Q4 2024 and is forecasted to remain at the same level in Q1 2025 driven by strong demand for HBM.

“Despite seasonality and the challenges of macroeconomic uncertainty, momentum in AI-driven investments continues to fuel expansion across key segments, including memory, capital expenditures, and wafer fab equipment,” said Clark Tseng, Senior Director of Market Intelligence at SEMI. “Looking forward for 2025, the industry remains cautiously optimistic, with robust growth prospects driven by ongoing demand for high-performance computing and data center buildout.”

“As we begin the year, our expectation is for stronger performance in the second half, with semiconductor sales anticipated to remain flat sequentially in the first half, followed by a notable double-digit increase in the latter half,” said Boris Metodiev, Director of Market Analysis at TechInsights. “Inventory challenges persist for discrete, analog, and optoelectronic manufacturers, which will need to be addressed before we can expect widespread growth to resume.”

The Semiconductor Manufacturing Monitor (SMM) report provides end-to-end data on the worldwide semiconductor manufacturing industry. The report highlights key trends based on industry indicators including capital equipment, fab capacity, and semiconductor and electronics sales, along with a capital equipment market forecast. The SMM report also contains two years of quarterly data and a one-quarter outlook for the semiconductor manufacturing supply chain including leading IDM, fabless, foundry, and OSAT companies. An SMM subscription includes quarterly reports.