Connectivity is one of the most frustrating aspects to tackle for designers of IoT networks. At the “edge” where sensors communicate with each other, there are multiple, mostly incompatible, competing standards. From the edge to the Internet and cloud there are only two: Wireless carriers and (LPWANs) in competition. LPWAN providers use more than one standard and some are proprietary, while the cellular industry roadmap focuses on streamlining and enhancing the capabilities of current offerings centered on the Long-Term Evolution (LTE) standard. So even though there are only two basic competitors in the longer-range market, it’s still necessary to have basic knowledge about each one, along with their advantages and disadvantages and applicability for a specific application.

Why All the Focus on Connectivity?

It comes down to money. Wireless carriers and LPWAN providers charge a fee for every connected device, and the number of IoT devices is growing rapidly. It took more than three decades for global wireless carriers to reach the current 2.3 billion subscribers, but in the few years that IoT services have been available, more than 8.4 billion IoT devices have been connected. By 2020, there should be at least 20 billion. Even though all IoT devices won’t ultimately connect to the Internet, “only” 10 billion of them would still create immense annual revenues for service providers. Needless to say, this is a huge revenue opportunity. However, there are broad differences between IoT applications, and the current capabilities of cellular-based and LPWAN solutions are different, so no single standard that will satisfy every need.

To illustrate these differences, consider that connecting “smart” electric utility meters (Figure 1) to the Internet in a city with 100,000 residences, businesses, and other water-using entities is vastly different from sending data outward from 250 machines in a single industrial facility. On a sprawling farm, many types of sensors are spread over miles of land rather than in a single building, and the seeming inevitability of autonomous vehicles will create a unique IoT environment of immense complexity requiring connectivity between vehicles as well as fixed infrastructure.

Figure 1: There are already nearly 70 million “smart” electricity meters in the U.S., each one transmitting periodic usage updates typically via a LPWAN but soon via cellular networks a well. (Source: Mouser)

Regardless of the application, services provided by wireless carriers and LPWAN providers have the common goal of allowing tiny sensors installed on host devices—such as valves, motors, and pumps—to communicate periodically to an external point for years while powered by a coin cell battery. Although both types of service providers attack this problem in somewhat different ways, both use a variety of techniques expressly designed for the IoT environment. For example, they limit the amount and duration of data transmission and times at which sensors must be communicating, and they also use very low data rates that require only narrow bandwidths.

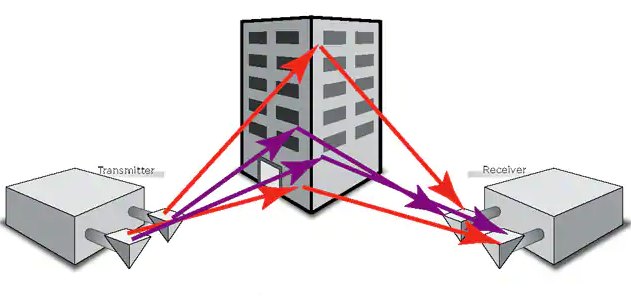

In addition, as low-power signals transmitted by wireless-enabled sensors are very weak, the base station receivers that detect them must be extremely sensitive. The base stations themselves must also use techniques such as Multiple Input Multiple Output (MIMO), illustrated in Figure 2, and in some cases use highly directional antennas to ensure constant connections.

Figure 2: Multipath propagation is generally considered highly undesirable, but MIMO exploits it to significantly increase network capacity using multiple transmit and receive antennas at both ends of the transmission path to minimize errors and optimize throughput. (Source: Mouser)

Figure 2: Multipath propagation is generally considered highly undesirable, but MIMO exploits it to significantly increase network capacity using multiple transmit and receive antennas at both ends of the transmission path to minimize errors and optimize throughput. (Source: Mouser)

Finally, many small base stations (the small cells) will be needed to shorten the distance signals must travel, which reduces latency to the almost instantaneous levels that some IoT applications require.

Cellular And LPWANs Compared

The cellular industry has unique advantages for IoT. Carriers already have almost ubiquitous LTE coverage in the US delivered by several hundred thousand macro base stations and perhaps three times that many small cells. Updating this infrastructure to accommodate communication with IoT devices in most cases requires just a software upgrade rather than a major investment in hardware such as RF and microwave transceivers. In addition, even before IoT was widely recognized as the next big thing, wireless carriers were already providing connectivity to wireless-enabled sensors using legacy Second-Generation (2G) technology.

The industry has also been working for years to accommodate IoT. The Third Generation Partnership Project (3GPP) that manages development and issuance of wireless standards has included substantial specifications dedicated to IoT in its latest standard called Release 13 that was finalized in June 2016. These capabilities will continue to be enhanced between now and when the first standards for the fifth generation of cellular will be released, most likely in 2019. By that time, wireless carriers will have a solid foundation in IoT connectivity.

In contrast, LPWAN providers have no such advantages. As they are entirely new entities in the wireless world, every system in every area where coverage is desired must be built from the ground up. They also have a limited time in which to deploy these networks in key (typically urban) areas, as the cellular industry is rapidly rolling out its IoT-centric data plans. Fortunately, LPWAN systems are less expensive to build and deploy than cellular networks, do not always require leasing space on a tower, and can cover wide geographical areas with fewer base stations.

The question today is whether LPWAN providers can survive in a cellular-dominated world. Most analysts believe they will, as they offer similar capabilities to cellular networks, such as carrier-grade security, and other mandatory features. They may become cost-competitive for customers as well. Analysts also suggest that at least half of IoT use cases can be served by LPWANs. It’s a relatively safe bet that, while the cellular industry will have a commanding presence in delivering IoT connectivity, there will still be room for LPWAN providers in what is likely to become a price war within individual markets.

Cellular IoT

The cellular industry is developing solutions for IoT connectivity based on LTE. The industry’s overall roadmap is to build on current versions of LTE and continue to refine it, including reducing its complexity and cost. As this process unfolds, cellular technology will become better suited to a wider variety of IoT applications, ultimately leading to the introduction of the fifth generation of cellular technology, 5G.

The consensus in the industry appears to be based on the use of three different standards mostly introduced in Release 13 to achieve this goal, ultimately resulting in what is included in the 5G standards. These solutions should ideally be implemented at frequencies below 1GHz where propagation conditions are more conducive to longer-range and building penetration:

LTE-M: Also called enhanced Machine Type Communication (eMTC), evolved from the LTE standard in Release 12 (2014) with further advances included in Release 13.

NB-IoT: A narrowband version of LTE for IoT included in Release 13.

EC-GSM-IoT: Extended Coverage-GSM for IoT is an extended coverage variation of Global System for Mobile Communications technology that was optimized for IoT in Release 13 and can be deployed along with a GSM carrier.

5G: Will be standardized by 2020, enhancing NB-IoT and EC-GSM-IoT.

The presumption is that, as the requirements for IoT are significantly different than those for traditional cellular operation, future developments should positively impact battery life using a power saving mode, reduce the complexity and thus cost of devices, reduce the cost of deployment by sharing carrier capacity, and enable broad coverage through the adoption of more advanced coding and increasing signals’ spectral density.

Table 1 illustrates the evolution of cellular technology. For example, Release 8 offered peak downlink rates up to 150mbs as it was designed for traditional cellular applications. However, data rates decline precipitously to 150kbs in narrowband to accommodate IoT requirements. The same is true for the channel bandwidths of user equipment, which declines from a maximum of 18MHz in Release 8 to 180kHz in narrowband IoT. Another important factor is the complexity of the modem, which decreases by 85% over time. In short, the evolution of cellular technology to meet the needs of IoT is in many respects precisely the opposite of what is hoped to be achieved in 5G for traditional voice and data services. That is, rather than increasing data rates, it reduces them along with the overall complexity of cellular IoT networks and their components.

| Specification | Release 8, Cat. 4 | Release 8, Cat. 1 | Release 13, Cat. 1 (eMTC, LTE-M) | Release 13, Cat. M1/NB1 (NB-IoT) |

| Peak download rate | 150Mb/s | 10Mb/s | 1Mb/s | 170Kb/s |

| User device receive (channel) bandwidth | 18MHz | 18MHz | 1.08MHz | 180kHz |

| Maximum user device transmit power (dBm) | 23dBm | 23dBm | 20/23dBm | 20/23dBm |

| Modem complexity (%) | 100 (baseline) | 80 | 20 | 15 |

The LPWAN Alternatives

LPWAN providers use either open standards such as LoRaWAN, administered by the LoRaWAN Alliance, or proprietary solutions like Sigfox, both of which operate in unlicensed spectrum. Although Sigfox claims it’s the world’s leading IoT connectivity service with service available in 32 countries (mostly in Europe), LoRaWAN has gained the widest industry acceptance with more than 400 members in the alliance. This translates into continually decreasing cost of LoRa baseband and RF hardware, which has already dropped by more than half and will likely decline further as volume increases.

LoRaWAN

It’s important to differentiate LoRa, LoRaWAN, and offerings by LinkLabs, as it can be a bit confusing. LoRa is the physical layer of the open standard administered by the LoRaWAN Alliance, while LoRaWAN is the Media Access Control (MAC) layer that provides networking functionality. LinkLabs is a member of the LoRaWAN Alliance that uses the Sematech LoRa chipset and provides a solution called Symphony Link that has features unique to the company, such as the ability to operate without a network server. Symphony Link uses an eight-channel base station operating in the 433MHz or 915MHz Industrial, Scientific, and Medical (ISM) bands as well as the 868MHz band used in Europe. It can transmit over a range of at least 10 miles and backhauls data using either Wi-Fi, a cellular network, or Ethernet using a cloud server to handle message routing, provisioning, and network management.

Sigfox

Sigfox was created by the French company by the same name. One of the major differences between it and LoRaWAN is that Sigfox owns all of its technology from the edge to the server and endpoint, and it effectively functions as the supplier of the entire ecosystem or, in some cases, as the network operator itself. However, the company allows its endpoint technology to be used free of charge by any organization that agrees to its terms, so it has been able to establish relationships with major IoT device suppliers and even some wireless carriers. Along with LoRaWAN, Sigfox continues to gain in market share, especially in Europe where its transmission length adheres to European Union guidelines. The version used in the U.S. is significantly different in order to meet Federal Communication Commission (FCC) rules. The only drawback to Sigfox is its proprietary nature.

Weightless

Weightless is an anomaly among IoT connectivity solutions, as it was developed as a truly open standard managed by the Weightless Special Interest Group (SIG). It gets its name from its “lightweight” protocol that typically requires only a few bytes of data per transmission. This makes it an excellent choice for IoT devices that communicate very little information such as some types of industrial and medical equipment, as well as electric and water meters. Unlike many other standards, Weightless operates in the so-called TV white spaces below 1GHz that were vacated by over-the-air broadcasters when they transitioned from analog to digital transmission. As these frequencies are in the sub-1GHz spectrum, they have the advantages of wide coverage with low transmit power from the base station along with the ability to penetrate buildings and other RF-challenged structures.

There are currently two Weightless versions:

- Weightless-N is an ultra-narrowband, unidirectional technology.

- Weightless-P is the company’s flagship bidirectional offering that provides carrier-grade performance and security with extremely low power consumption, and other features.

Nwave

Nwave is an ultra-narrowband technology based on Software-Defined Radio (SDR) techniques that can operate in both licensed and unlicensed frequency bands. The base station can accommodate up to 1 million IoT devices over a range of 10Km with RF output power of 100mW or less and a data rate of 100bps. The company claims that battery-operated devices can operate for up to 10 years. When operating in bands below 1GHz, it takes advantage of the desirable propagation characteristics in this region.

Ingenu

Ingenu (formerly called On-Ramp Wireless) has developed a bidirectional solution based on many years of research, which resulted in a proprietary direct-sequence spread spectrum modulation technique called Random Phase Multiple Access (RPMA). RPMA was designed to provide a secure wide-area footprint with high capacity operating in the 2.4GHz band.

A single RPMA access point covers 176mi.² in the U.S., which is significantly greater than either Sigfox or LoRa. It has minimal overhead, low latency, and a broadcast capability that allows commands to be sent simultaneously to a very large number of devices. Hardware, software, and other capabilities are limited to those provided by the company, and the company builds its own public and private networks dedicated to machine-to-machine communications.

Summary

As only the cellular industry and LPWAN providers are competing for the top spot in the longer-range market, it’s easy to assume that the designer’s job is simple when compared with that required for short-range solutions. Instead, each competing technology offers an extraordinary range of variables, all of which contribute to their capabilities yet present major design challenges.

For end users, choosing the “right” solution will generally come down to which services are available in their area and how much they charge for connecting each device. However, if multiple wireless carriers and LPWAN providers operate in a given area, the decision becomes more challenging. For general IoT connectivity, it will take years before clear winners are established.

About the Author

Barry Manz is a contributing writer for Mouser Electronics and president of Manz Communications, Inc., a technical media relations agency he founded in 1987. He has since worked with more than 100 companies in the RF and microwave, defense, test and measurement, semiconductor, embedded systems, lightwave, and other markets. Barry writes articles for print and online trade publications, as well as white papers, application notes, symposium papers, technical references guides, and Web content.

Click here for more information