Sensors: The Key Driver of Automotive Innovation

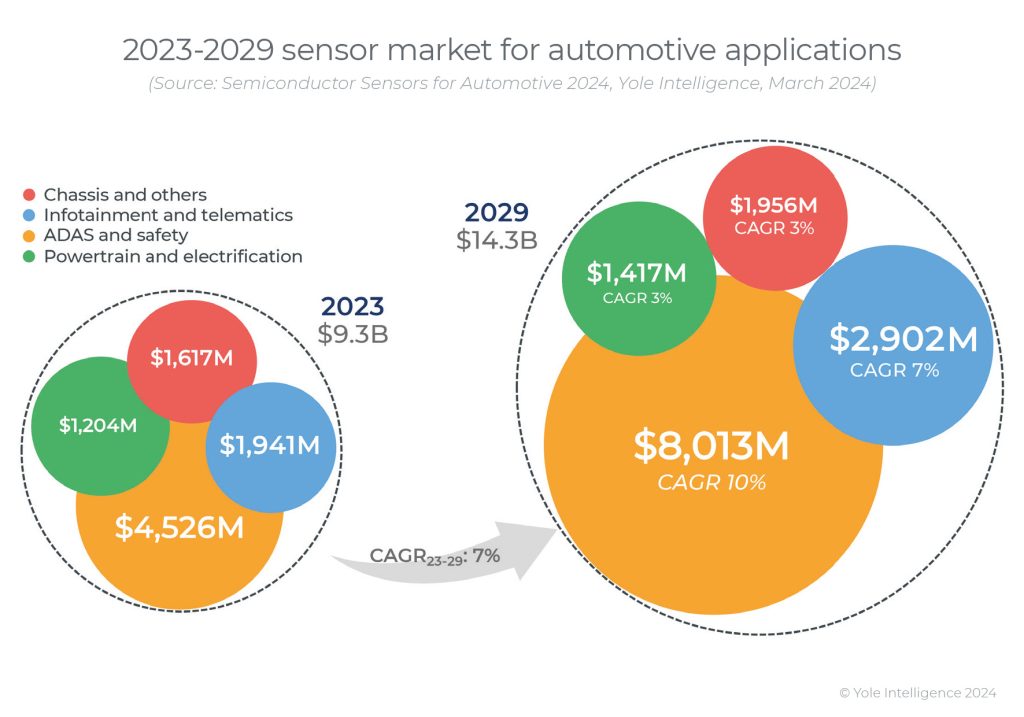

Since the 20th-century introduction of semiconductors in automobiles, sensing technologies have steadily expanded. Initially aimed at enhancing powertrain efficiency, sensors like ABS, ESC, and airbags have become indispensable due to increasing safety priorities. Technological advancements have transitioned these innovations from luxury vehicles to mid-range and budget models, creating a multi-billion-unit industry. In 2023, 6.5 billion automotive sensors were shipped globally, generating $9.3 billion in revenue. With a 7% revenue CAGR from 2023 to 2029, the market is expected to reach $14.3 billion, with 8.8 billion sensors shipped worldwide. The automotive industry is poised for massive transformations in all four car domains:

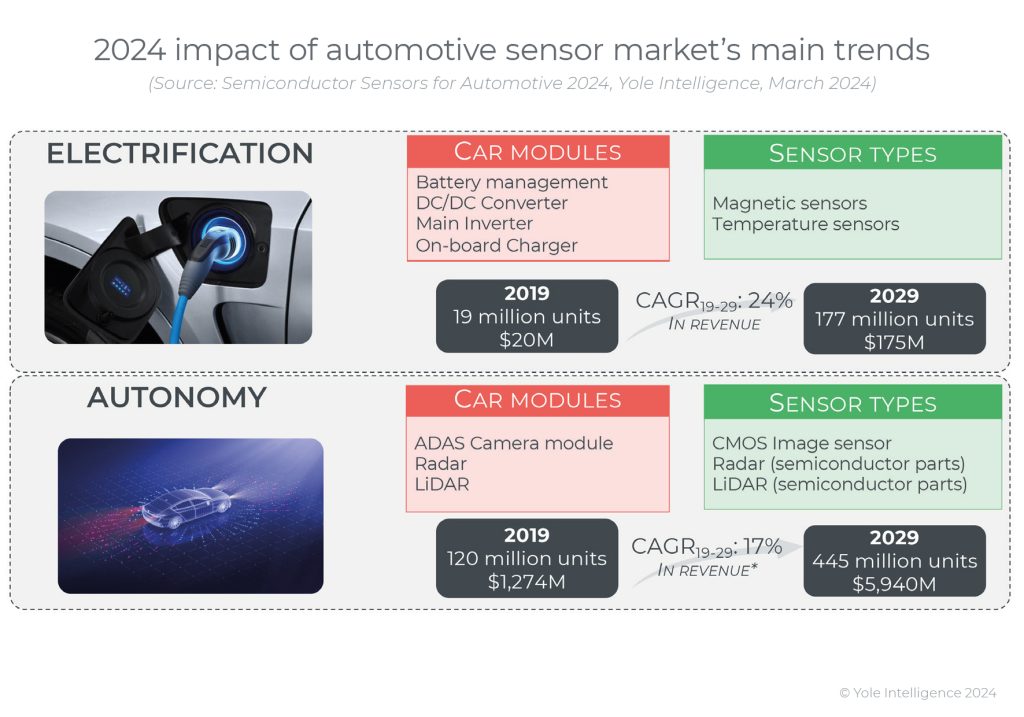

- Powertrain and Electrification: The industry is shifting from internal combustion engine (ICE) cars, which constituted 91% of production in 2019, to electrified cars, expected to represent 43% of production by 2029. The Powertrain and Electrification sensor market will exceed $1.4 billion by 2029, growing at a 3% CAGR from 2023 to 2029. Electrification will drive critical changes in the sensor landscape, creating new applications and phasing out others.

- ADAS and Safety: Cars are becoming more intelligent, with sensors like cameras, LiDARs, and radars enabling cars to understand and react to their environment. The ADAS and Safety segment is projected to generate $8 billion in revenue by 2029, making it the largest segment.

- Infotainment and Telematics: This sector is driven by increased functionality and in-cabin comfort, with customers demanding better entertainment options. It is projected to achieve a 7% CAGR from 2023 to 2029, surpassing $2.9 billion by 2029.

- Chassis and Others: To enhance passenger safety, send valuable data to the ADAS computing unit, and eliminate hydraulic parts, sensor volumes are expected to grow at a 3% CAGR from 2023 to 2029. Revenue from this segment is expected to reach almost $1.9 billion by 2029.

Advancements in ADAS, autonomous driving, and electrification, alongside widespread sensor adoption, are set to transform automotive sensor technology. This will lead to substantial industry reorganization and supply chain changes, necessitating strategic business planning and partnerships to capitalize on emerging opportunities.

The Changing Automotive Market: Impacts on Sensor Manufacturers

The growth or decline of sensor manufacturers will depend on their strategic positioning within the market as vehicles increasingly embrace electrification and advanced driver assistance systems (ADAS) and safety features.

- ICE Applications: Suppliers of sensors used in traditional ICE applications (e.g., engine pressure sensing, emission control, engine management systems) will face declining demand. This impact will become more pronounced by the decade’s end, especially with the 2035 ban on new ICE cars in Europe.

- New Prospects: Suppliers of MEMS pressure sensors and gas & particle sensors, such as Bosch, TE Connectivity, NXP, and Infineon, will find new opportunities in thermal runaway and CO2 sensing applications. Preventing thermal runaway at the battery level is critical for OEMs, and CO2 sensing is becoming a key in-cabin comfort feature.

- Magnetic and Temperature Sensors: Suppliers like Allegro Microsystems, Melexis, Infineon, and Sensirion will see significant opportunities. Monitoring current and temperature parameters is essential for understanding EV performance, leading to robust revenue growth for these players.

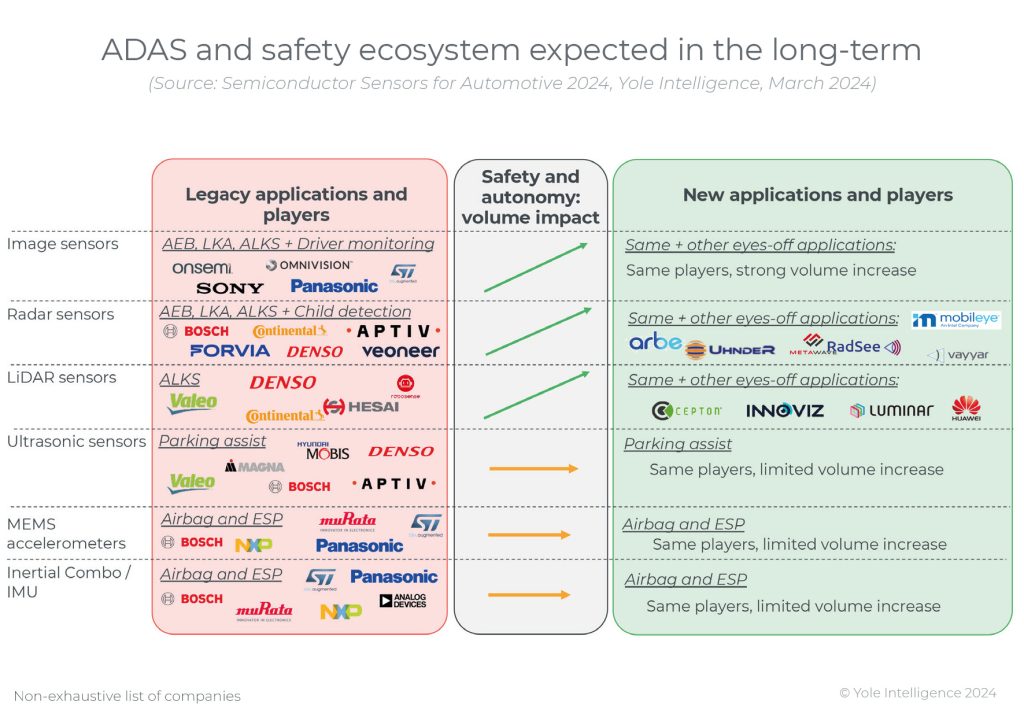

The increased presence of ADAS and safety components will primarily impact companies involved in image, radar, and LiDAR sensors.

- Safety Applications: As airbags and ESP become standard in nearly all vehicles, the expansion of MEMS accelerometers and inertial combo/IMUs will depend on vehicle sales growth. This trend is expected to generate substantial sales volumes for leading players such as Bosch, Murata, NXP, and STMicroelectronics.

- Image and Radar Sensors: These sensors are projected to experience significant growth due to the expanding adoption of Autonomous Emergency Braking (AEB) features in semi-autonomous vehicles.

Projected Future Technological Developments Spanning All Car Domains

Though electrification and ADAS & safety are primary drivers, technology will evolve in all car domains.

- Powertrain and Electrification: Increasing battery capacities and advancing 800V batteries will drive the adoption of magnetic (isolated) technologies for current sensing in components like OBC, DC/DC converters, inverters, and power modules. Magnetic sensors will replace shunt sensors due to their lack of galvanic isolation. Additionally, maintaining optimal battery temperature is crucial for performance, safety, and lifespan. Magnetic sensors on thermal valves will regulate cooling or heating fluids more precisely, keeping sensor content per BEV around $15 per car.

- ADAS and Safety: CMOS image sensors will evolve to increase frame rates, dynamic range, and temperature resistance, meeting the needs of Tier-1s and OEMs. Radar sensors will advance with 4D imaging radar achieving a 1° angular resolution. LiDAR technology will improve in range, transitioning from avalanche photodiodes to more sensitive SPADs and SiPMs. The introduction of FMCW LiDAR by the end of the decade could change the technology landscape, with semiconductor content for ADAS and Safety sensors per car growing from $51 in 2023 to $82 in 2029.

- Infotainment and Telematics: Integration of sensors for comfort features will increase. MEMS sensors will improve phone call quality and enable noise-canceling functionalities. Capacitive sensors will replace physical buttons, and radar technology will be used for occupant monitoring. Environmental sensors will enhance in-cabin air quality.

- Chassis and Others: Innovations will focus on brake and drive-by-wire technologies to eliminate hydraulic components. Magnetic sensors will be essential for pedal position sensing and motor position monitoring. Intelligent TPMS modules will measure tire pressure and provide insights into tire quality and vehicle load. Additionally, applications for monitoring driver’s seating position and making slight adjustments during extended journeys will emerge.

Citations from Yole Group