The United States, China, and India are known for their significant contributions to the global automotive industry. Let’s dive into the details of each market and analyze the factors that make them unique and influential on a global scale.

Currently, the USA leads with a market size of Rs 78 lakh crore, followed by China at Rs 47 lakh crore. India, now at Rs 22 lakh crore, has significant potential.

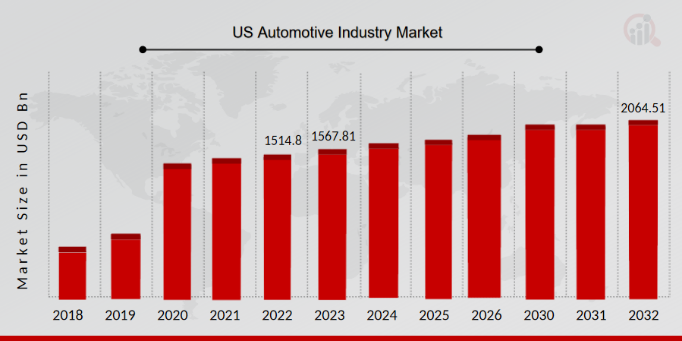

The US Automotive Market: The United States has one of the largest automotive markets in the world. With a population of over 330 million people, there is a high demand for vehicles in the country. In 2020, the US automotive market was valued at approximately $1.5 trillion. This value includes the sales of new cars, as well as aftermarket services and products.

The market is anticipated to witness increased demand for commercial vehicles due to the thriving logistics and passenger transportation industry. Government policies and initiatives is also a market driver that have a significant impact on its growth and are anticipated to continue doing so in the years to come.

One of the key drivers of the US automotive market is consumer demand. Americans have a strong preference for larger vehicles such as trucks and SUVs, which contribute significantly to the overall market size. Additionally, the US is home to several major automakers such as General Motors, Ford, and Tesla, which further stimulate market growth.

The China Automotive Market

China is the largest automotive market in the world in terms of vehicle sales. With a population of over 1.4 billion people, the demand for cars in China is immense. In 2020, the Chinese automotive market was valued at approximately $1.5 trillion, on par with the US market.

One of the key factors driving the growth of the Chinese automotive market is the rising middle class. As incomes in China continue to increase, more people are able to afford cars, leading to a surge in vehicle sales. Additionally, the Chinese government has implemented policies to promote the production and adoption of electric vehicles, further boosting market growth.

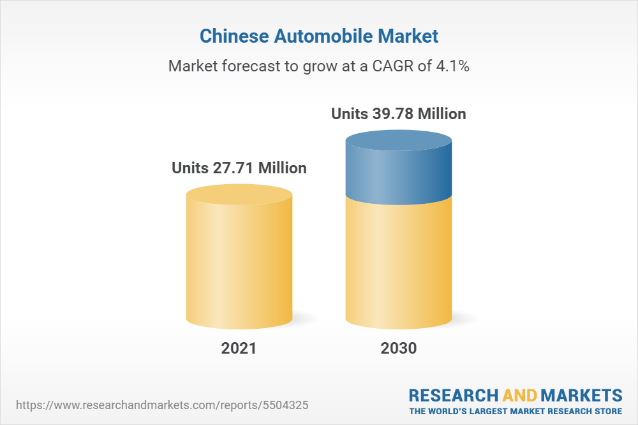

China Automotive Vehicle Industry is expected to grow with a CAGR of 4.10% from 2021-2030.

The Chinese automotive industry is uniquely situated to become a centre for the best technologies. By Category, the Chinese automotive vehicles industry’s principal categories include Electric Vehicle (EV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Mild Hybrid Electric Vehicle (MHEV), Natural Gas Vehicle (NGV), Fuel Cell Electric Vehicle (FCEV), Diesel Vehicle, Petrol Vehicle. In recent years, Electric vehicles (EV) and Mild Hybrid Electric vehicles (MHEV) have been very successful in China. In particular, due to the Chinese government’s support and the cost-saving trend offered through buying an electric vehicle, which avoids the cost of purchasing a license plate, which is indeed a considerable saving.

The India Automotive Market

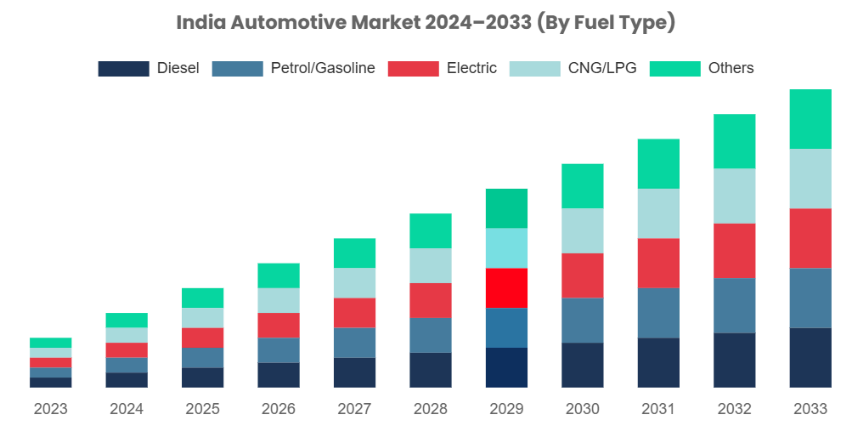

India is another key player in the global automotive industry. With a population of over 1.3 billion people, India has a large consumer base for vehicles. In 2020, the Indian automotive market was valued at approximately $100 billion, significantly smaller than the US and China markets.

One of the main drivers of the Indian automotive market is the increasing urbanization of the country. As more people move to cities, the demand for vehicles, especially two-wheelers and compact cars, is on the rise. Additionally, government initiatives such as the “Make in India” campaign have encouraged domestic production and manufacturing in the automotive sector.

In conclusion, the US, China, and India are three key players in the global automotive market, each with its unique characteristics and drivers of growth. While the US and China have larger market sizes, India is a rapidly developing market with great potential for future expansion. By understanding the size and dynamics of these markets, stakeholders can make informed decisions and capitalize on opportunities for growth and innovation.

Some of the recent/planned investments and developments in the automobile sector in India are as follows:

- The Renault-Nissan alliance is stepping up its investments in India plans to invest US$ 600-700 million at its Chennai-based facility to step up platform localisation and improve sophistication levels in manufacturing.

- Mercedes Benz will make an investment of Rs 3,000 crore (US$ 360.14 million) in Maharashtra.

- In March 2024, Tata Motors Group has signed a facilitation Memorandum of Understanding (MoU) with the Government of Tamil Nadu to explore setting-up of a vehicle manufacturing facility in the state. The MoU envisages an investment of US$ 1,081.6 million (Rs. 9,000 crores) over 5-years.

- Tata Motors, in April 2024, announced the inauguration of a new commercial vehicle spare parts warehouse in Guwahati.

- In April 2024, Maruti Suzuki India Limited, commissioned another vehicle assembly line at its Manesar facility.

- In February 2024, Hyundai Motors has announced it will invest over US$ 3.85 billion (Rs 32,000 crore) from 2023 to 2033 in expanding its EV range and enhancing its current car and SUV platforms.

- In January 2024, Mercedes-Benz is set to invest US$ 24.04 million (Rs 200 crore) in India in 2024 and is gearing up to introduce more than a dozen new cars, including EVs this year.

- In February 2024, Klaus Zellmer CEO of Skoda Auto said India is the most promising growth market for Skoda Auto and Skoda Auto India is looking to increase its share in the Indian market to 5% by 2030.

- In April 2024, Hero Motocorp said it has opened an assembly facility in Nepal in partnership with its distributor CG Motors with capacity of 75,000 units per annum.

- Ola Electric IPO to be the first auto company in India to launch an IPO in over two decades (20 years). It has an expected size of US$ 1.01 billion (Rs. 8,500 crore).

- In January 2024, BMW sold 1,340 luxury cars, the highest in the segment, which gave it a market share of 0.34%. Mercedes-Benz sold 1,333 cars in January 2024.

- In January 2024, Hyundai Motor India Limited announced US$ 743.8 million (Rs. 6,180 crore) investment plans in the state of Tamil Nadu including US$ 21.7 million (Rs. 180 crore) towards a dedicated ‘Hydrogen Valley Innovation Hub,’ in association with IIT- Madras.

- In January 2024, Hyundai Motor India Ltd. finalized the acquisition and transfer of specified assets at General Motors India’s Talegaon Plant in Maharashtra and inked an MoU with the Government of Maharashtra committing to an investment of US$ 722 million (Rs. 6,000 crore) in the state.

- In January 2024, Mahindra & Mahindra Ltd. and the India-Japan Fund (“IJF”), managed by the National Investment and Infrastructure Fund Limited (“NIIF”), entered into a binding agreement, with IJF committing to invest US$ 48.1 million (Rs. 400 crore) in Mahindra Last Mile Mobility Limited (MLMML).

- In January 2024, at the Vibrant Gujarat Global Summit, Maruti Suzuki announced the investment plans in Gujarat with a New Greenfield plant and a fourth line in SMG.