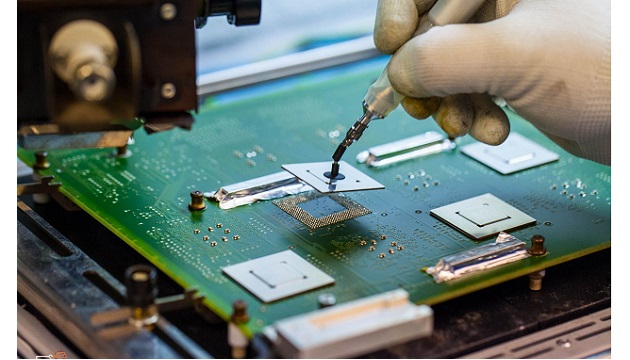

Surface mount technology equipment facilitates widespread solution for different end-use industry which include automotive, aerospace and defense, consumer electronics, healthcare and industrial. One of the major factor encouraging the demand and high-speed installation of surface mount technology equipment is its operational effectiveness owing to cost effective processing.

With the increasing technological advancement, the application of printed circuit board in consumer electronics sector such as smart phones, tablet, and computer, Liquid Crystal Display (LCD) and Light Emitting Diode (LED) among others is rapidly increasing across different industry verticals.

Consumer electronics held the largest market share followed by industrial segment and is expected to remain the leading end-use industry. Placement and soldering equipment technology is used in different consumer electronics manufacturing industry which in turn has increased application scope of the surface mount technology equipment market. In addition, with the introduction of industrial devices and smart electronic devices, the market for SMT cleaning equipment is expected to increase due to growing adoption of cleaning equipment in their production line.

Placement equipment held the largest market share followed by soldering equipment. The growing demand for printed circuit board in smartphones in order to fulfill the demand of smartphones is having a positive impact on the market for surface mount technology equipment market.

Growing usage of flex circuit in wearable electronics across various sector especially in smart phone and smart card industry is the primary factor to foster the demand and innovation of surface mount technology market

Healthcare is the foremost sector in triggering the growth prospect of surface mount technology equipment market. Penetration of electronics and automated products in healthcare industry drive the opportunity for surface mount technology equipment market in this segment.

Manufacturing prowess in last five years in India

Vipin Chauhan, AGM, Sales and Business Development, NMTronics is quite bullish about Indian manufacturing prowess. He said, “Yes, indeed it was way too much expected out of new government formation in 2014, because of their leadership’s style of working. Not everything expected has been achieved but many appreciable initiatives have been taken during their tenure to ensure expected is achieved. The most important initiative is “Make it India.” This is not just an initiative but also an intent what this government wanted during their tenure of five years, which has taken India into limelight thereby showcasing it as Global Manufacturing Hub. With right decisions and policy frame works drawn to attract foreign investments, to promote local manufacturing and to indigenisation of products, have made strong foundation for years to come. This can be witnessed by the Chinese and other foreign investors foraying and setting up their plants in India. They have realised the power of real potential in India, as their own country is getting expensive day by day. With economical man power and incentives of capital investments have drawn them to India, as prime destination. This whole process have not just increased the numbers of jobs available but also exposed our human resource with global standard of manufacturing.”

On answering the electronics manufacturing prowess of India in last five years Dr. Sreeram Srinivasan, CEO, Syrma Technology, said that, “the Indian electronics and system design manufacturing (ESDM) industry has been the focus of attention and is widely recognized as one of driving forces in our vibrant and modern economy. The domestic electronic manufacturing industry has spiked from a growth rate of 5.5% in FY15 to 26.7% in FY18. This growth is supported by various government initiatives such as Make in India and Smart Cities project which aids a holistic approach to economic development. With Make in India initiative thrusting the need for domestic manufacturing of electronics hardware, our country has seen an immense growth in mobile phone manufacturing, where the number of mobile and accessories manufacturing companies has increased to over 260 companies and employing over 6.7 Lacs people, as per the report of The India Cellular and Electronics Association (ICEA).”

Dr. Sreeram Srinivasan is of the opinion that, “the government has showed its strong intention towards achieving zero dependency on imports for meeting the electronics hardware demand through policies such as the Modified Special Incentive Package Scheme (M-SIPS), Electronics Development Fund (EDF), Preferential Market Access (PMA), etc. These initiatives will facilitate growth in local manufacturing of electronics hardware over the coming years.”

Explaining Manufacturing prowess of India in last five years Aditya Ratnaparkhi, Executive Director, EMST Marketing discusses that, “Indian manufacturing industry has come a long way in last 5 years. Now many companies are in process of setting up or have already setup their large scale manufacturing units in India and in next five years it is going to grow.

Speaking to ELE Times Suresh Nair, Director, Leaptech Corporation said that, “Manufacturing has emerged as one of the high growth sectors in India. Prime Minister of India had launched the ‘Make in India’ program to place India on the world map as a manufacturing hub and give global recognition to the Indian economy. This has helped the Indian industry especially the electronics industry, many foreign companies have setup facilities in India in the past 5 years for manufacturing mobile phones, consumer electronics, automotive electronics, etc. Smart phone manufacturing has seen a tremendous growth in the last 3~4 years which is a great achievement of this current government.”

Areas that drive manufacturing the most

Responding to the sectors that drive manufacturing Vipin Chauhan, AGM, Sales and Business Development, NMTronics said, “Inevitably, the Mobile Phone manufacturing is the one big segment driving the need for manufacturing in India, which has profoundly come up quite strong in last few years. Till 2014, India had less than 3 mobile manufacturing plants established. Now, India has more than 268 Plants manufacturing Mobile phones in India, making us the Second highest mobile phone producer in the world, after China. From the production capacity of 3 Million units till 2014, India has produced, 11 Million handsets in 2017. This accounts for approx 11% of global production from mere 3% in 2014. With this increase in production, Telecom industry is one of the top five employment opportunity generator in India. This whole success story is both geo-political as well as efforts of current government. With the Introduction of PMP – Phase Manufacturing Program in 2017, by Government of India to built a robust indigenous mobile phone production ecosystem, it has transformed companies from being importer to Manufacturer. The levying of duty from Mobile Phone chargers to planned Vibrator Motors and Ringer, won’t leave any stone unturned into making India a Global manufacturing hub.”

On asking the areas that drive manufacturing the most Dr. Sreeram Srinivasan states that, “growing customer base and increased penetration of consumer durables have provided enough scope for the growth of the Indian electronics sector. Mobiles and consumer devices accounts for close to 45% of country’s demand for Electronics and high initiatives have been taken to meet the demands locally.”

He further added that,” In addition to increment in demand for broadband and communication equipment’s, IoT devices in the country as a result of Government’s Digital initiatives, Smart cities paved way for Industry growth and demand, which needs to be addressed for localization. The market will also see significant demand from emerging application areas like automotive electronics, including electric vehicles and connected mobility related applications.”

On answering the manufacturing driver Aditya Ratnaparkhi said that, “we’ve seen boom in lighting industry in past few years with many Indian companies entering into this segment and expanding their capacities both SME & Corporates. In coming year consumer goods and industrial electronics manufacturing will be dominating factors for our industry.

Suresh Nair stated on the areas that drive manufacturing the most that, “electronics industry has seen a good Manufacturing growth in the last years. Other industries are also gaining manufacturing momentum. Automotive industry will have good growth with the Electric Vehicle sale starts picking up.”

Products that drive manufacturing the most

Commenting on the hot selling products of NMTronics Vipin Chauhan said, “Fuji NXTIII Platform is all time favourite for Industry. Its flexibility, modularity, scalability and reconfigurability make it outstanding performer for critical and complex product assembly. With Demand for entire SMT machine solution have drastically gone up in last couple of years. We are seeing upsurge in investments by foreign companies into Mobile Phone and accessories segment. These investments are usually done for multiple SMT lines, targeted for Chinese mobile phone brands, established or establishing in India. This can be witnessed with shortage of skilled manpower Industry is facing today. The best indicator of this is the Machines sales data. The number of machines being sold by us has gone up to 5 times in last two years.”

Dr Sreeram Srinivasan further elaborated on the drivers of manufacturing that, “we see demand for Automotive Electronics is scaling up due to electronification and electrification of the vehicles as a result of increasing need for safety and comfort. Being 4th largest Automotive Industry in the world, self-reliance is imperative for electronics. Whereas now close to 65% of electronics for this industry are met through imports. We as an Industry body understood the vital importance and potential of Auto Electronics market and established a dedicated state-of-the-art and model Electronics Manufacturing Service factory for India in the Delhi Mumbai Industrial corridor, which will serve this Industry.”

On the products that are in demand in the industry Nair said that, “all our equipment that are meant for PCB Assembly automation – like Yamaha, ITW EAE and Omron have seen good growth in the years gone by. Other products like Deprag Screwdriving automation has also gained a handsome growth.”

Expectations from the new Electronics policy

Vipin Chauhan is hopeful about the New Electronics Policy. He said that, “We expect New Electronics Policy to be extension on Modifies Special Incentive Package Scheme (MSIPS). This policy gave initial thrust required to the industry by motivating business houses with lucrative incentives on capital investments. As on date only 75% i.e 22.5 Crores, of the total India consumption of mobile phones are produced, even after levying duties under PMP. We still have a lot to do in this segment. Also, total exports for electronics goods is about USD 6.4 Million however the imports are ever increasing, creating higher trade deficits. We expects this new policy to address all these issues in the right manner so as to motivate businesses, to invest more for Indian markets with most of the raw material sourced locally.”

Electronics policy has been talked about extensively in the industry. Dr Sreeram Srinivasan candidly spoke about that, “the NEP 2019 was formulated with a vision to position India as global hub of ESDM Industry by supporting domestic manufacturers through financial interventions, Phased Manufacturing Program (PMP), developing core competencies in emerging technologies. As an Industry body, our expectations would be having government support in introducing PMP for all identified key areas, supporting manufacturers with Plug-n-play infrastructure and providing competitiveness against FTA’s.”

On the outcome of the NEP 2019, Nair said, “the new policy will help electronics industry to grow for sure. The policy will attract a lot of foreign and domestic investment. This could be an enhanced version of the erstwhile MSIPs scheme.”

Real manufacturing Vs. Assembling in India

‘Make in India’ has long been criticized for not manufacturing in India. Commenting on Real manufacturing Vs. Assembling in India, Vipin Chauhan, AGM, Sales and Business Development, NMTronics said, “We have to start from somewhere at least to achieve what we want to be, may be in a few years down the line. It is way too early to conclude the results of MAKE IN INDIA. I feel it will still take at least 5 years more to get into proper shape and be productive the way we expected it to be. Expecting anything right now will be injustice to it. India doesn’t have strong Research & Development and hence initially we have to start with Assemble in India. Once we excel in this phase, we will have substantial knowledge of products at large.”

“Critics want MAKE IN INDIA, to have everything made in India, which is totally impractical for country of this size. Neither India has enough quality Raw material required for this nor is it that easy to start from chip level manufacturing, as it takes big investments, knowledge of the process and the most important substantial market size. At this point of time, Make in India is making India a big market for these chips with sustainable numbers year on year. Once the market place is set the investors will plan investments for these chips,” Vipin said.

Make in India has been discussed a lot in last five years. Dr. Sreeram Srinivasan has his frank opinion that, “Make in India is to be viewed as a journey with ongoing change and not as a short term project. From 2014, the Indian manufacturing ecosystem has gone through a radical change with companies increasingly considering to setting up units in India to serve the domestic and global markets. The domestic production of electronics Industry registered a growth of 21% CAGR, where mobile phone manufacturing accounted for the largest share, followed by consumer electronics. Having said that, the value addition of electronics production in India is still low; say in the range of 5 to 30% is a clear indicator that there is still room for improvement.”

“We have long way to cover in terms to innovation and government’s support in framing effective policies to rapidly scale up the domestic components industry. We, as a part of the Industry, believe in self-initiatives such as Design-Led manufacturing, Excellence Led-Manufacturing which will increase the value addition from the company and Industry eventually,” said Dr. Srinivasan.

On big debate around manufacturing Vs. assembly, Aditya Ratnaparkhi opined that, “the new policy should be encouraging to the entire value chain rather than final assembly i.e. raw material, capital goods equipment required for assembly which will help in establishing India as a long term vibrant manufacturing hub.”

Talking on the distinction between manufacturing and assembling Nair said that, “Critics have failed to understand that electronics product manufacturing involves more of assembly of parts only. This activity should also be considered manufacturing only. If we are talking about component manufacturing then yes we do not have many local manufacturing setup. This is one area the new government needs to focus more in the coming years.”