Blockchain technology is a decentralized, distributed ledger that securely records the ownership of digital assets. The data stored on a blockchain is immutable, making the technology a significant disruptor in industries such as payments, cybersecurity, and healthcare.

As an immutable digital ledger, blockchain enables secure transactions across a peer-to-peer network. It uses decentralized methods to record, store, and verify data, removing the need for intermediaries such as banks or governments. Every transaction is documented and stored within a block on the blockchain. These blocks are encrypted for protection and linked to the preceding block, forming a chronological chain—hence the name “blockchain.” Without the consensus of the network, the data stored on a blockchain cannot be altered or deleted. This new-age database acts as a single source of truth and facilitates trustless and transparent data exchange among interconnected computers.

Beyond moving cryptocurrencies between wallets, blockchain technology holds wide-ranging application potential. It can help prevent fraudulent banking activities, alleviate supply chain bottlenecks, and safeguard medical records. Blockchain, as an advanced database system, facilitates transparent information sharing across a business network. The data is stored in blocks linked together in a chronological chain, ensuring that it cannot be deleted or modified without network consensus. This capability makes blockchain technology perfect for establishing an unchangeable ledger to track orders, payments, accounts, and various other transactions. Built-in mechanisms prevent unauthorized entries, ensuring consistency in the shared view of transactions.

Blockchain serves as a shared, immutable ledger that records transactions and tracks assets within a business network. Assets can be tangible, like houses, cars, cash, and land, or intangible, such as intellectual property, patents, copyrights, and branding. By tracking and trading virtually anything of value on a blockchain network, the technology reduces risk and cuts costs for all participants.

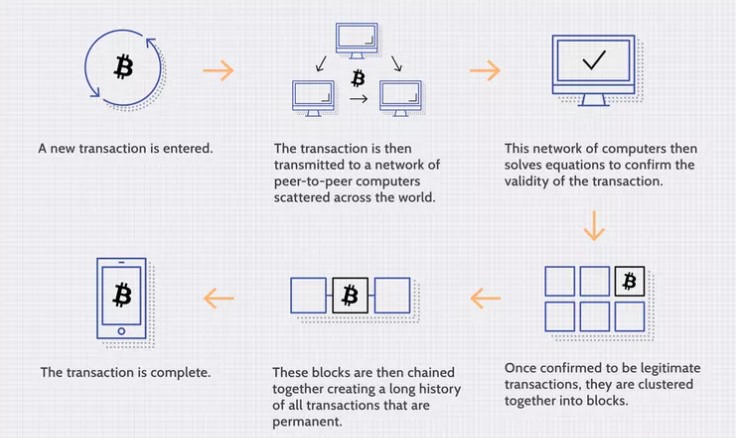

Blockchain: Understanding Its Core Mechanisms in Four Steps

Blockchains are distributed data-management systems that record every exchange between users. These immutable digital records employ various methods to establish a trustful system that operates without intermediaries.

Each block contains stored data and a unique alphanumeric code called a hash, which acts as a digital fingerprint. Blocks are linked together using these hashes, creating a chronological sequence and providing tamper-proofing. Any alteration in the hash generates a different string, making it easy to spot and reject invalid blocks.

Decentralization is another crucial aspect of blockchain. Instead of a central authority, control is distributed across a peer-to-peer network of interconnected computers, or nodes. These nodes constantly communicate to keep the digital ledger updated. During transactions, all nodes participate in validating the transaction using consensus mechanisms. Built-in protocols ensure all nodes agree on a single data set, and blocks can only be added once verified and consensus is reached. Smart contracts, which are self-executing programs coded into the blockchain, have streamlined this verification process.

Once recorded, transactions are permanent, as blockchains do not allow reversible actions This immutability promotes transparency throughout the network and guarantees a reliable record of all blockchain activities.

Blockchain technology, while complex, can be broken down into four basic steps, often automated by blockchain software:

Step 1 – As each transaction occurs, it is recorded as a “block” of data:

A blockchain transaction records the exchange of physical or digital assets between parties within the network. This transaction is recorded as a data block, detailing who was involved, what occurred, when and where it happened, why it took place, the quantity of the asset exchanged, and the pre-conditions met during the transaction.

Step 2 – Gain consensus:

To be deemed valid, a transaction must receive consensus from the majority of participants in the blockchain network. The rules for achieving consensus are typically established at the network’s inception and can vary depending on the network type.

Step 3 – Link the blocks:

Once consensus is achieved, the transaction is added to a block, akin to a page in a ledger. Each block includes a cryptographic hash, which links it to the previous block, forming a chain. Any alteration in the block’s contents changes the hash value, enabling easy detection of tampering. This chaining process securely links blocks, making them immutable and strengthening the verification of previous blocks and the entire blockchain.

Step 4 – Share the ledger:

The updated central ledger is distributed to all participants in the network, ensuring everyone has the latest copy.

Types of Blockchain Networks

- Public Blockchain

Public blockchains are entirely open and decentralized, allowing anyone with internet access and a computer to participate. These permissionless networks grant all participants equal rights to read, edit, and validate the blockchain. Common uses include cryptocurrency exchanges and mining, with notable examples being Bitcoin, Ethereum, and Litecoin.

- Private Blockchain

In contrast, private blockchains are more centralized and controlled by a single organization, making them more secure. These managed blockchains restrict access, allowing only selected nodes to participate. Examples include Ripple, a digital currency exchange network for businesses. Key characteristics are:

– Restricted access compared to public blockchains.

– Available only to authorized users.

– Operated within a closed network.

– Participation limited to specific members of an organization.

- Hybrid Blockchain

Hybrid blockchains integrate features of both private and public blockchains. Organizations can control certain parts while making others publicly accessible. This setup uses smart contracts to allow public verification of private transactions. For example, a hybrid blockchain might enable public access to digital currencies while keeping bank-owned currency data private. Features include:

– Integration of public and private blockchains.

– Utilization of both permission-based and permissionless systems.

– User access managed via smart contracts.

– Primary entities cannot alter transactions despite ownership.

- Consortium Blockchain

Consortium blockchains, or federated blockchains, are governed by multiple preselected organizations that share responsibility for maintaining the blockchain and setting access permissions. This type is well-suited for industries with common objectives, like the Global Shipping Business Network Consortium, which seeks to digitize the shipping industry and improve cooperation among maritime operators. Key aspects include:

– A collaborative solution managed by multiple organizations.

– Combination of public and private blockchain features.

– Shared governance and responsibility.

Blockchain Transforms Industries: From Banking to Supply Chain Integrity

Blockchain technology is being used in various industries beyond cryptocurrencies. Notably, it offers a secure and efficient way to store data and track transactions. Companies like Walmart, Pfizer, AIG, Siemens, and Unilever are experimenting with blockchain. For instance, IBM’s Food Trust blockchain traces food products to ensure safety by quickly identifying contamination sources, thereby preventing widespread foodborne illnesses.

In the banking sector, blockchain can revolutionize transaction processing by providing faster and more secure fund transfers, reducing the time and risk associated with traditional banking operations. For stock trading, it can expedite the settlement process, cutting down the time taken to clear trades.

In healthcare, blockchain can securely store medical records, ensuring they are tamper-proof and accessible only to authorized individuals. Property records can benefit by moving from inefficient, error-prone manual processes to a secure, immutable digital ledger, which is particularly useful in areas with weak governmental infrastructure.

Smart contracts, powered by blockchain, facilitate automated transactions when predefined conditions are met. In supply chains, blockchain enhances transparency by tracking the origin and journey of products, validating claims like “Organic” and “Fair Trade.”

The technology also has potential applications in voting systems, enhancing security and transparency while reducing fraud and increasing voter turnout. In the energy sector, blockchain facilitates peer-to-peer energy trading and enables crowdfunding for renewable energy initiatives.

Finance uses blockchain to streamline online payments, account management, and market trading. For example, Singapore Exchange Limited employs blockchain for more efficient interbank payments. In media and entertainment, blockchain improves copyright data management, ensuring fair compensation for artists and reducing costs. Retail companies, like Amazon, are using blockchain to verify the authenticity of goods in their supply chains, ensuring trust in the products sold.

Bitcoin vs. Blockchain: Distinct Concepts with Broad Technology Applications

Bitcoin and blockchain are often used interchangeably, but they are distinct concepts. Bitcoin was one of the first applications of blockchain technology, leading to some confusion. However, blockchain has many uses beyond Bitcoin.

Bitcoin is a decentralized digital currency designed for online financial transactions. It is now regarded as a digital asset that can be converted into various global currencies like USD or euros. Bitcoin transactions are managed by a public blockchain network that maintains a central ledger.

The Bitcoin network operates through a public ledger that records all transactions. Servers worldwide, known as nodes, hold copies of this ledger, functioning similarly to banks. Unlike traditional banks, which only track their customers’ transactions, Bitcoin nodes are aware of every Bitcoin transaction globally.

Anyone can set up a node with a spare computer, effectively creating their own Bitcoin bank.

In the Bitcoin network, cryptocurrency is mined by solving cryptographic puzzles to generate new blocks. Transactions are broadcast publicly to the network and shared between nodes. Approximately every ten minutes, miners compile these transactions into a new block and permanently add it to the blockchain, serving as the definitive Bitcoin ledger.

Mining demands significant computational power and time due to the complexity of the process. In return, miners earn a small amount of cryptocurrency. Miners function like modern clerks, recording transactions and collecting transaction fees.

The network uses blockchain cryptography technology to achieve consensus on coin ownership among all participants.