Ashok Leyland on Monday said that it was in active discussion with investors to raise funds not just for its electric vehicles (EV) arm Switch Mobility but also its new e-mobility-as-a-service (e-MaaS) unit Ohm Global Mobility.

While the company was non-committal on the quantum of fund raise for Ohm, the company may be looking at raising anywhere between USD 50-100 million and the negotiations are in the final stages.

Switch Mobility is alternatively in talks with investors to raise up to USD 200 million and it is also on the final stages of closing the deal.

“We are in active discussion with investors both for investment in Switch as well as for the e-mobility-as-a-service business,” Gopal Mahadevan, director and chief financial officer at Ashok Leyland said during a press briefing.

The Ohm Global Mobility will be operational from 1st of April 2022. It will provide electric vehicles as a service to state transport undertakings (STU) and commercial fleet operators on an operating cost basis rather than an outright purchase. The lessee will have to pay a fee per kilometre of use.

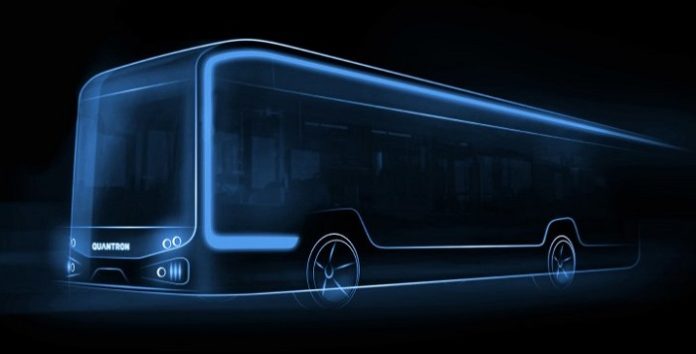

Mahesh Babu, the chief executive of Switch Mobility in India, told that the company has so far delivered around 100 electric buses. It is currently participating in various tenders for around 5000-6000 electric buses.

“We are aggressively looking at being amongst the top two bidders for 5500 buses of CESL. In the next two years, we should be eying a volume of 2000 buses at least. While Switch Mobility will acquire these buses, Ohm will run the operation,” added Babu.

Ohm’s services will be of importance especially in India, where companies are required to provide electric buses on an op-ex (operating expense) model to STUs to get subsidies under the government’s flagship EV promotion scheme FAME.

Other electric bus makers like Olectra already have a group company to provide its electric buses to STUs on an op-ex model.

Apart from STUs, Ohm will also be catering to other commercial vehicle fleet operators and also provide vehicle subscription, battery-as-a-service and other value-added fleet management services, as per its website.

As an eMaaS player, Ohm will require funds to acquire a fleet of electric vehicles that it can then provide to its customers.

Switch Mobility, the electric vehicles arm of Ashok Leyland, secured orders for 40 electric buses from Chandigarh and 300 from Bangalore Metropolitan Transport Corporation during the December quarter, the company said on Monday under the FAME scheme. These orders will have to be fulfilled on an op-ex basis.

The reported last month in an exclusive interview with Ashok Leyland chairman Dheeraj Hinduja that the company was in advanced discussions with multiple investors to raise close to USD 200 million for its electric vehicles (EV) arm Switch Mobility. Ohm is a unit of Switch.

The UK-headquartered company was valued at USD 1.6 billion after a small strategic stake sale to auto components maker Dana in July last year.

The stock of Ashok Leyland dipped 6.84% to Rs 123.85 on the BSE on Monday compared to a 3% dip in benchmark Sensex. The scrip has lost 5% over the last one year.